At Outbuilders, we often get asked about the tax implications of pole barns. It’s a common question that many property owners grapple with.

Are pole barns taxable? The answer isn’t always straightforward and depends on several factors.

In this post, we’ll break down the key elements that determine whether your pole barn is subject to taxation and what you need to know as a property owner.

What Are Pole Barns and How Are They Taxed?

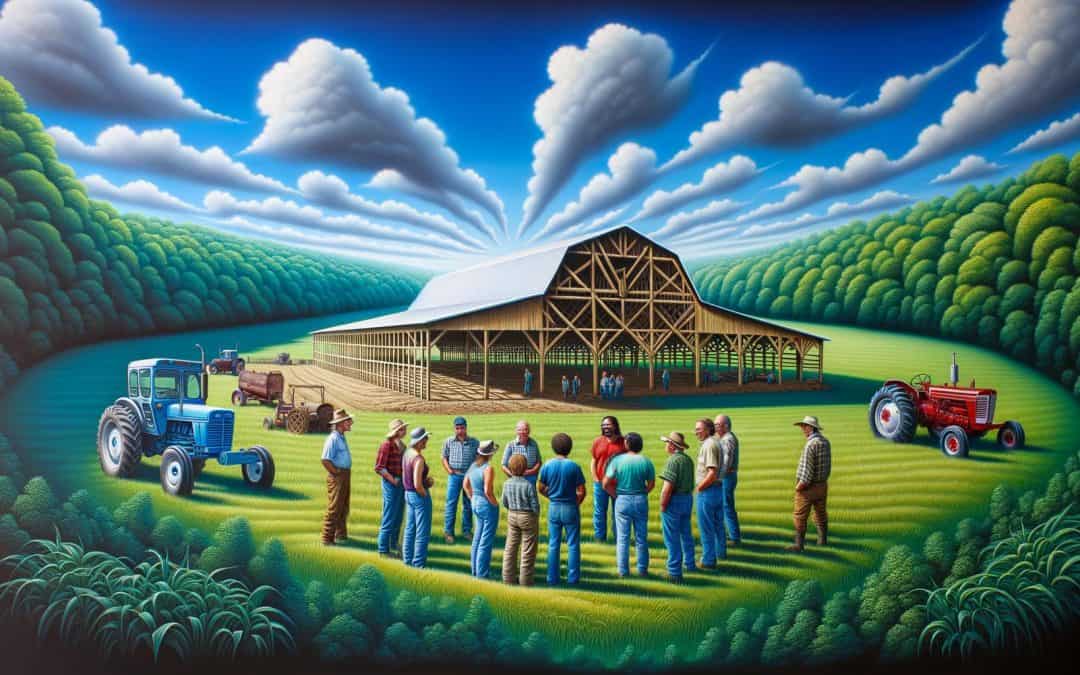

Pole barns have become increasingly popular among property owners due to their versatility and functionality. These large, open buildings are supported by poles or posts embedded in the ground and serve various purposes, from agricultural use to storage and workshops.

Definition and Structure of Pole Barns

Pole barns stand out for their unique construction method. Unlike traditional buildings, they don’t require a continuous foundation. Instead, they rely on sturdy poles (often treated wood or steel) that are sunk deep into the ground. This design allows for quick construction and cost-effectiveness, making pole barns an attractive option for many property owners.

Local Tax Laws and Pole Barns

The taxation of pole barns varies significantly depending on local regulations. Some jurisdictions exempt pole barns used for agricultural purposes from property taxes. For instance, Iowa offers tax exemptions for certain agricultural buildings that meet specific criteria. However, this isn’t a universal rule. Property owners must check with their local tax assessor to understand the specific regulations in their area.

The Impact of Usage on Taxation

How you use your pole barn can significantly affect its tax status. Pole barns used for commercial purposes are more likely to face taxation. This underscores the importance of understanding how your intended use might impact your tax obligations.

Permanent vs. Temporary Structures

The permanence of a pole barn can influence its taxability. Structures considered permanent additions to your property are more likely to be taxed. The National Agricultural Law Center classifies most pole barns as permanent structures due to their size and construction method. However, the definition of a permanent structure can vary by location. In some areas, a pole barn without a concrete foundation might be considered temporary and thus exempt from property taxes.

Value Assessment and Property Taxes

Even if your pole barn is taxable, its impact on your property taxes may vary. Tax assessors typically consider the value that the pole barn adds to your property. A high-end, fully finished pole barn will likely increase your property value more than a basic structure, potentially leading to a more significant tax increase.

The taxability of pole barns isn’t straightforward. It depends on a complex interplay of local laws, usage, permanence, and value. To navigate these complexities, let’s explore the specific factors that determine whether a pole barn is taxable in the next section.

How Tax Authorities Assess Pole Barns

Tax authorities employ various methods to assess pole barns for taxation purposes. This process involves several key factors that property owners should understand.

Permanence and Structure Type

Tax assessors primarily focus on the permanence of a pole barn. Structures with concrete floors are typically considered taxable in some states. In Vermont, for instance, structures must have foundations extending below the frost line (about five feet) to receive classification as permanent. Some jurisdictions, however, might view pole barns without concrete foundations as temporary, potentially exempting them from property taxes.

Purpose and Usage

The intended use of your pole barn significantly influences its tax status. Agricultural use often receives preferential treatment. The IRS categorizes farming businesses as those that cultivate, operate, or manage a farm for profit (as outlined in Publication 225, the Farmer’s Tax Guide). Pole barns used primarily for farming operations may qualify for agricultural exemptions in many states.

Commercial use typically triggers taxation. If you use your pole barn for business purposes, expect it to become part of your property’s assessed value. Residential use falls somewhere between agricultural and commercial, with its tax implications often depending on local regulations.

Local and State Regulations

Tax laws for pole barns vary dramatically across jurisdictions. Some counties utilize satellite surveys to measure square footage, which directly impacts property taxes upon completion of new structures. Others may have specific thresholds for when assessed values can increase.

It’s essential to consult your local tax assessor before construction. They can provide insights into how your area values pole barns and what exemptions might be available. Some regions offer farmland assessment programs that allow for additional buildings without adverse tax effects.

Value Assessment

The value a pole barn adds to your property plays a crucial role in its tax implications. Tax assessors consider factors such as:

- Construction quality

- Size and features

- Intended use

- Market conditions

A high-end, fully finished pole barn will likely increase your property value more than a basic structure, potentially leading to a more significant tax increase.

Disclosure and Documentation

Full disclosure of your pole barn’s intended use to tax authorities is critical. We’ve observed cases where property assessments nearly doubled upon converting a pole barn to residential use. Maintaining accurate records of how you use your pole barn can help justify tax exemptions if questioned by authorities.

As we move forward, let’s explore the potential tax implications for pole barn owners and how these assessments can affect your overall property taxes.

How Will a Pole Barn Affect Your Taxes?

Property Value and Assessment Changes

Adding a pole barn to your property will likely increase your property’s assessed value. The increase varies based on the pole barn’s size, quality, and features. A basic 30×40 foot pole barn might add $15,000 to $30,000 to your property value, while a larger, more elaborate structure could add $50,000 or more.

This increase in assessed value typically leads to higher property taxes. The exact amount depends on your local tax rate. For example, if your local property tax rate is 1%, a $30,000 increase in assessed value would result in an additional $300 in annual property taxes.

Tax Deductions and Exemptions

Pole barns can offer opportunities for tax deductions or exemptions. If you use your pole barn for agricultural purposes, you might qualify for agricultural exemptions, which can significantly reduce your property tax liability.

For business use, you can depreciate pole barns over time. The IRS allows for a 20-year depreciation period for most farm buildings. This means you can deduct a portion of the barn’s cost each year, reducing your taxable income.

Some states offer additional incentives. For instance, Indiana allows certain farm structures to be eligible for a property tax deduction. However, if you buy or make improvements to farm property, such as a post-frame barn, you cannot deduct its entire cost in one year. Always check with your local tax authority or a tax professional to understand available deductions or exemptions in your area.

Reporting Requirements

You must report your pole barn to avoid potential legal issues and unexpected tax bills. Most jurisdictions require you to report new structures to the local assessor’s office within a specific timeframe (often 30 to 60 days after completion).

Failure to report can result in penalties. Property owners have faced back taxes and fines when unreported structures were discovered during routine property assessments.

When reporting, prepare to provide these details about your pole barn:

- Size and dimensions

- Construction materials

- Intended use

- Cost of construction

- Any special features or improvements

Accurate reporting keeps you compliant and ensures you’re not overassessed. If you believe the assessed value of your pole barn is too high, you have the right to appeal. Many jurisdictions have a formal appeal process, which typically requires you to provide evidence supporting your claim of a lower value.

Impact on Overall Tax Burden

The addition of a pole barn to your property can have a noticeable impact on your overall tax burden. While the increased property value often leads to higher taxes, the benefits of additional storage or workspace may outweigh the costs for many property owners.

It’s important to consider the long-term financial implications of adding a pole barn. Try to factor in not only the initial construction costs but also the ongoing tax obligations when making your decision. In some cases, the increased functionality and potential for business use (which could lead to additional income) might offset the higher tax burden.

Final Thoughts

The taxability of pole barns depends on local regulations, structure permanence, intended use, and impact on property value. Property owners must consult local tax authorities before starting a pole barn project to understand specific rules and potential exemptions. Professional tax guidance can help navigate complex regulations, identify deductions, and ensure proper reporting to avoid penalties.

Pole barns can increase property value and functionality, but they may also affect tax obligations. Careful planning and consideration of both short-term and long-term financial implications are essential when deciding to add a pole barn. Property owners should weigh the benefits of additional storage or workspace against potential increases in tax burden.

For those in Central Oregon seeking to add a high-quality pole barn to their property, Outbuilders offers customized solutions tailored to individual needs. Outbuilders provides expert craftsmanship and on-site construction to ensure that pole barns meet storage requirements and complement property value. Property owners can make informed decisions that align with their goals and financial plans by understanding the tax implications of pole barns.

Trackbacks/Pingbacks